A Circuit Court has subject matter jurisdiction to enter a child custody order pursuant to the Illinois Constitution. But the Court apparently lacks jurisdiction to proceed pursuant to the Uniform Child Custody Jurisdiction and Enforcement Act (750 ILCS 36/201). If the Circuit Court proceeds anyway, is the resulting order void, voidable, or something else? In other words, where does the subject matter jurisdiction of the Illinois courts come from?

A Circuit Court has subject matter jurisdiction to enter a child custody order pursuant to the Illinois Constitution. But the Court apparently lacks jurisdiction to proceed pursuant to the Uniform Child Custody Jurisdiction and Enforcement Act (750 ILCS 36/201). If the Circuit Court proceeds anyway, is the resulting order void, voidable, or something else? In other words, where does the subject matter jurisdiction of the Illinois courts come from?

That’s the question that the Illinois Supreme Court debated late last month, hearing oral argument in McCormick v. Robertson, a decision from the Fourth District.

McCormick is a custody battle over the child of a brief relationship between a resident of Illinois and a resident of Missouri. In 2010, the father – the Illinois resident – filed a petition to establish father and child relationship, custody and related matters in the Circuit Court in Illinois. The mother – who lived in Missouri with the child – appeared pro se, and the parties presented a joint parenting agreement. Subsequently, a final judgment of parentage and custody was entered.

Three years later, the father filed a petition in the same court, seeking to terminate the joint parenting agreement and gain sole custody. The mother responded with a petition arguing that under the UCJEA, the Illinois court had never had subject matter jurisdiction, so its order was void (subject matter jurisdiction can’t be waived or conferred by consent). The Illinois court and a Nevada court where the mother had initiated proceedings held a telephone conference call and concluded that under the UCJEA, the Nevada court had subject matter jurisdiction. Subsequently, the 2010 judgment of parentage and custody was vacated as void by the Illinois court, and the father’s petition was dismissed with prejudice.

The Appellate Court reversed. The proposition that the UCJEA deprived the Illinois court of jurisdiction presupposed that statutes could add or subtract from Illinois courts’ subject matter jurisdiction, the court held. But it wasn’t so; Illinois courts’ subject matter jurisdiction flowed from Article VI, Section 9 of the state constitution, which confers jurisdiction in the circuit courts over “all justiciable matters” (with limited exceptions not relevant here). This conclusion flowed directly from the Illinois Supreme Court’s holding in Belleville Toyota, Inc. v. Toyota Motor Sales. Since it was obvious that the child custody dispute was a “justiciable matter,” if the statute couldn’t add to or subtract from the trial court’s jurisdiction, it followed that the Illinois court’s original order wasn’t entered without subject matter jurisdiction, wasn’t void, and therefore couldn’t be collaterally attacked three years after it was entered.

Counsel for the mother began the oral argument before the Supreme Court. Counsel noted that both Nevada and Illinois have asserted jurisdiction over the dispute. The mother was not and never had been a resident, nor was the child. Justice Karmeier asked whether it mattered that at the time the judgment was entered in Illinois no other state had attempted to assume jurisdiction. Counsel said no. Because the child resided in Missouri at the time, that state could have asserted jurisdiction, but Illinois had never had a claim under the statute. Justice Karmeier asked if the UCJEA trumped the state constitution. Counsel answered that the provisions of the statute do trump the constitutional provisions. Justice Thomas asked counsel whether his position was contrary to Belleville Toyota. Counsel responded that Belleville Toyota deals only with constitutional jurisdiction. Counsel argued that courts still find statutory limits on jurisdiction in particular kinds of cases, notwithstanding Belleville Toyota. Even when the court has subject matter jurisdiction, power to render a certain kind of decision is another matter. Justice Thomas asked whether the court would have to overrule Belleville Toyota to find for the mother, and counsel responded no. Justice Thomas asked whether the court would be carving out an exception for certain kinds of cases. Counsel responded that the court would either be carving out an exception, or merely taking a different view of some types of cases. Justice Thomas suggested that Belleville Toyota means that with the exception of administrative actions, this is how Illinois law addresses subject matter jurisdiction. Counsel answered that since that time, there have been decisions defining types of cases outside the strict Belleville Toyota framework. Justice Thomas asked whether a bright line rule would assist the bar. Counsel responded yes. Justice Theis asked counsel to respond to the Appellate Court’s reading of Siegel v. Siegel, which predated Belleville Toyota. Counsel responded that Siegel was published before the UCJEA was enacted, and deals with constitutional jurisdiction, not statutory limitations. Justice Theis suggested that there was a practical issue – the mother could have objected to the original Illinois trial court order, or appealed, and the issues would have been sorted out long before. Counsel was suggesting that the agreed order could be attacked anytime. Counsel responded that if there was no subject matter jurisdiction, there could be no waiver, and the Illinois order could be attacked forever. Justice Theis suggested that if that were so, then there was no finality in the order. Counsel said no, there wasn’t; if the order was void, and the trial court lacked subject matter jurisdiction, the order was subject to collateral attack. Justice Karmeier asked whether there was a possible argument that the Illinois court had jurisdiction, and had it until it conceded jurisdiction in 2013, meaning that the 2010 order was final. Counsel said no, if the trial court lacked jurisdiction, the order can’t be in limbo until somebody actually challenges it. Justice Karmeier asked whether that was right, given that the UCJEA had never been raised to the Illinois court in 2010. Counsel answered that the statute was still applicable at that time. Justice Karmeier asked whether the court would have to overrule Belleville Toyota, or carve out an exception to it. Counsel argued that there are cases carving out certain circumstances in which the Illinois courts should not exercise jurisdiction. The court might have had jurisdiction absent the UCJEA, but the statute applied from the outset.

Counsel for the father followed. Counsel argued that the mother agreed to the order, was questioned in court, had an opportunity to object to jurisdiction, and never did so. Justice Thomas asked if any of that is relevant if the trial court lacked jurisdiction. Counsel explained that he was responding to opposing counsel’s comments. Belleville Toyota is perfectly clear, counsel argued – this is a justiciable matter, the trial court had jurisdiction to rule, right or wrong, and it’s done. Chief Justice Garman asked what implications there would be for states adopting model legislation if the court held that the UCJEA was irrelevant to the jurisdictional issue. Counsel said no, but the UCJEA is a procedural statute, and the defendant had an obligation to raise it. Chief Justice Garman asked whether the father’s theory was that the mother essentially conferred jurisdiction on the Illinois courts by failing to raise the UCJEA. Counsel answered that the mother had thirty days to appeal, or two years to challenge the judgment under Section 2-1401. The Chief Justice again pointed out that counsel appeared to be arguing that the mother’s failure to raise the UCJEA initially was fatal. Counsel said yes, the mother was raising a provision of the statute regarding initial determinations of custody. Justice Thomas asked whether counsel agreed that a bright line rule would be helpful. He observed that the court has a number of cases on jurisdiction pending, so the law didn’t appear to be especially clear. Did counsel agree, or was it simply a matter of following Belleville Toyota? Counsel responded that the issue was clear. Even if there are theoretical exceptions to the rule, nothing in this case justifies adopting an exception to the bright line rule of Belleville Toyota. The mother’s position muddies the bright line of Belleville Toyota, counsel argued. It would cast doubt on long-resolved cases. A party doesn’t wait four years to attack a judgment, counsel argued. The mother argued that the UCJEA was about statutory jurisdiction, but there’s no such thing. Subject matter jurisdiction flows from the Illinois constitution, not the statute.

Counsel for the mother concluded the argument. Counsel explained that the mother had acted now because the father had petitioned to change custody in 2013. The court had ordered the mother to come to Illinois and bring the minor child with her. The UCJEA was set up to determine which state would get custody jurisdiction at certain points. The parties went through the entire statutory process the way it’s supposed to happen, with two judges in two states. So now, the case has two courts which have accepted jurisdiction. Because an interstate jurisdictional problem is involved, counsel argued, the case presents different issues than have existed in many earlier cases. The issue would continue to be defined and redefined by the courts, counsel concluded. A bright line rule would be helpful to practitioners. Counsel concluded by asking the court to affirm the trial court.

We expect McCormick to be decided in three to four months.

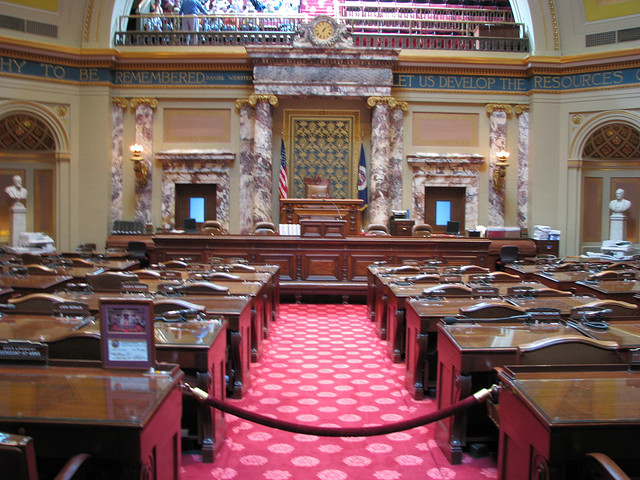

Image courtesy of Flickr by Bert Kaufmann (no changes).